We send reminder notices if:

- you don't pay the correct amount; or

- you don't pay on time.

What to do if you receive a reminder

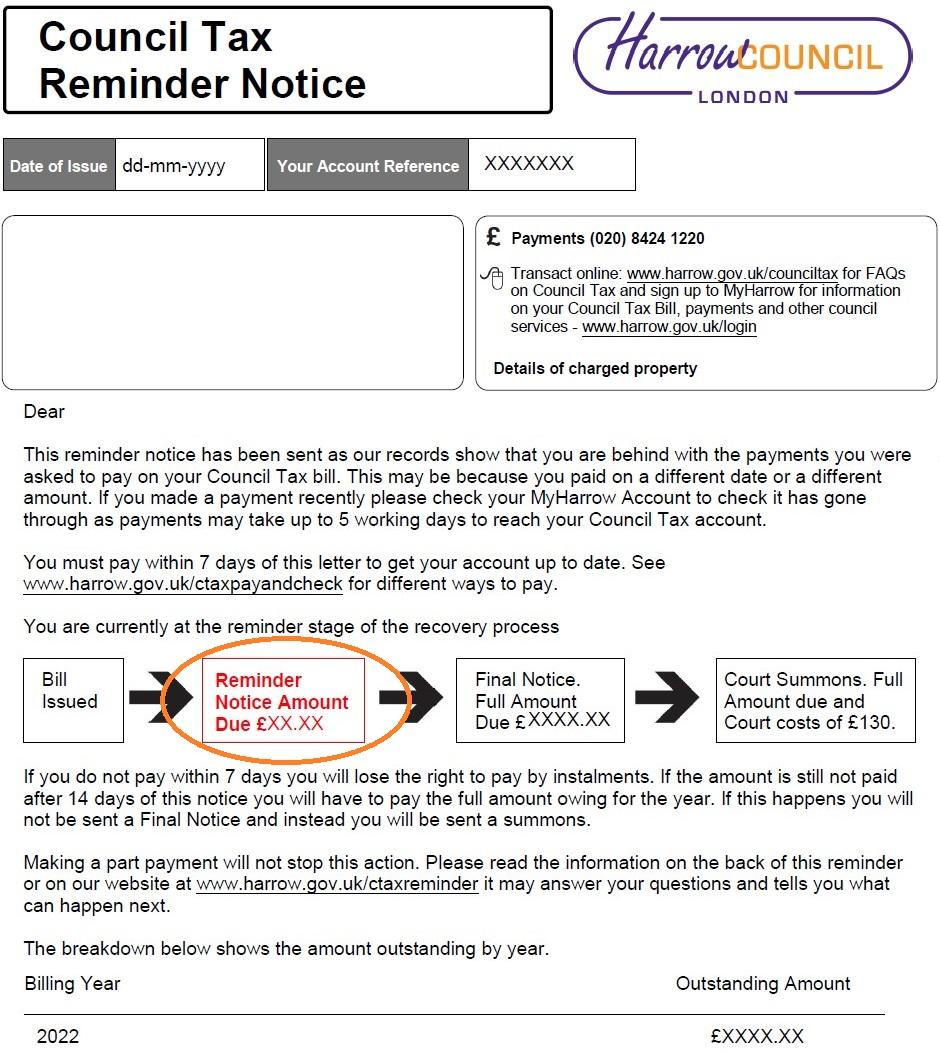

- You must pay the Amount you owe on the reminder or Second Reminder within 7 days of its date. The date is at the top of the notice

- You must make future payments on time. We will send a maximum of 2 reminders before you lose the right to pay by instalments.

To pay by phone call 020 8424 1220. You will need to have your Council Tax Reference number. For other payment methods, see Paying your council tax.

We do not send reminders for each missing or late payment. To avoid receiving notices in future, find out how to manage your payments.

What will happen if you do not pay the Reminder

If you do not pay the amount you owe within 7 days of its date of issue, you may be sent a summons. You will then lose the right to pay by instalments.

When the summons is issued you will incur costs of £125. This will increase the amount you owe. The Council has a duty to protect public funds and the summons allows more debt recovery options.

If you don't pay in full when you get the summons, including the £125, we'll ask the court for a Liability Order. It will include an extra £5. The date of the hearing will be on the summons. The Council must receive the payment in your Council Tax Account to stop the Liability Order. You can check this on MyHarrow.

What to do if you cannot pay the Reminder

If you cannot pay, then a summons will be sent. The following actions may not prevent this, but can make it easier to manage by reducing the amount owed.

- Check if you can get a Discount or Council Tax Support. This may not stop the summons, but could reduce the debt. This will make it easier for you to manage payments.

- Pay as much of the arrears as you can afford

- Check if you are paying over 10 months or 12. If over 10 months, you can ask for your payments to be extended to March of each year. This will reduce your monthly payments. You can do this by setting up a Direct Debit. We will send you a new bill telling you the reduced instalments.

- Get debt advice and financial support. This may help you reduce other bills, and get the right support.

What to do if you think the Reminder notice is wrong

If you think that the reminder is wrong, you can send a dispute. You will need to provide:

- a letter explaining why you think it is wrong

- any relevant supporting evidence.

You will need to pay while you are waiting for a decision.

Select the reason for your dispute for guidance:

I have made the payments, but the Council has not received them

Check MyHarrow to see if and when the Council received the payments. If a payment is missing, you will need to send proof of payment.

We can accept the following as proof:

- a bank or credit card statement showing that payment has been made

- a receipt

- any other valid proof that you have to show the missing payment

Please also attach a written explanation of your dispute. This can be a saved file, such as an MS Word document.

If you have moved out or should not be liable

If you received payment reminders for an address you have already left, notify us using the move form. You must continue to pay the Council Tax until you receive the closing bill.

If you believe you're not liable for the charge, you can submit a dispute using the evidence upload form. You must pay the amount on the reminder and continue to make payments while you are waiting for a decision.

I cannot afford to pay

If you cannot afford the charge, check to see if you qualify for a reduction. Recovery action will continue in the meantime if you do not pay.

I did not receive the bill

If you did not receive the original bill then you can check it on MyHarrow. You must pay the amount shown on the reminder. Not receiving a bill or reminder notice is not a valid defence against a summons.

I am waiting for the outcome of an application

If you have not paid while waiting for the outcome of an application then the reminder is correct. You must always pay your Council Tax while waiting for a decision on any type of application.

You can use your MyHarrow account to check the progress of your application.

If you have recently set up a Direct Debit, check your MyHarrow account to see if it has been set up. You will need to pay any instalments shown as outstanding.

How to send your dispute

Before you send your dispute:

- have your dispute letter and supporting evidence ready to upload

- have your Council Tax Reference number

- before you access the form, you can sign in to your MyHarrow Account. If you do not have an account, please select 'Complete a form without logging in'.

You must make any outstanding payments while you wait for a decision on your dispute. A decision can take up to 50 days.