You will receive a summons if:

- you didn't pay the correct amount

- you didn't pay on time on more than one occasion

- your payments didn't reach your council tax account on time

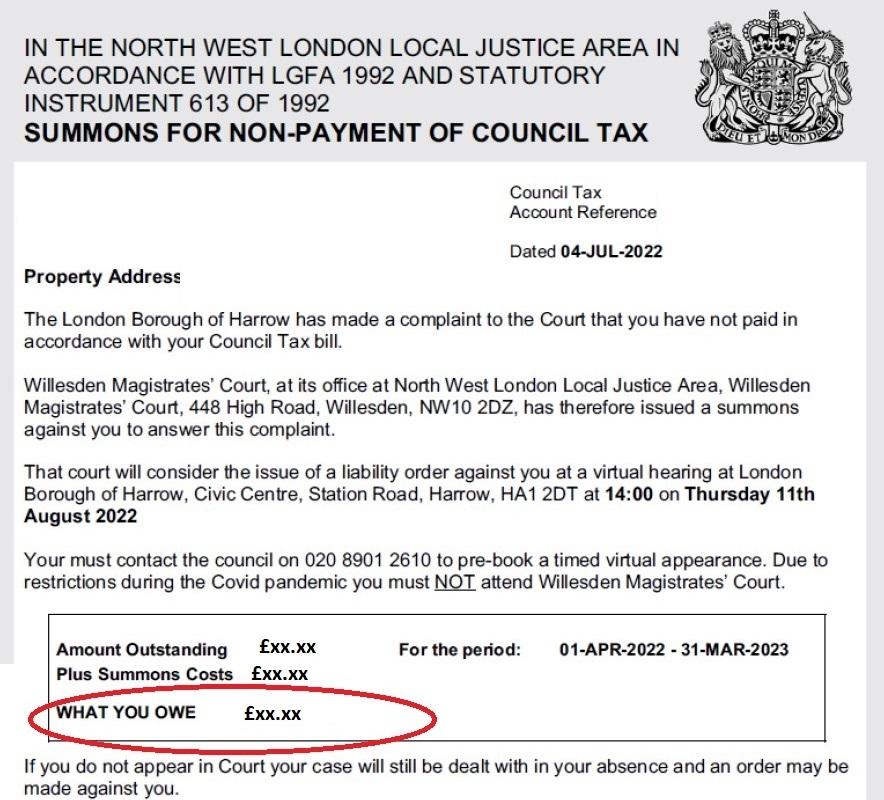

The summons will state the amount you owe and a court hearing date.

Scroll down to find out what to do next, or watch our explainer video:

What to do when you receive a summons

The easiest way to pay what you owe is to either:

- Pay in full: Pay the full amount, including the summons costs. If you do this before the court date you avoid the £5 Liability Order costs. (How much do I owe?)

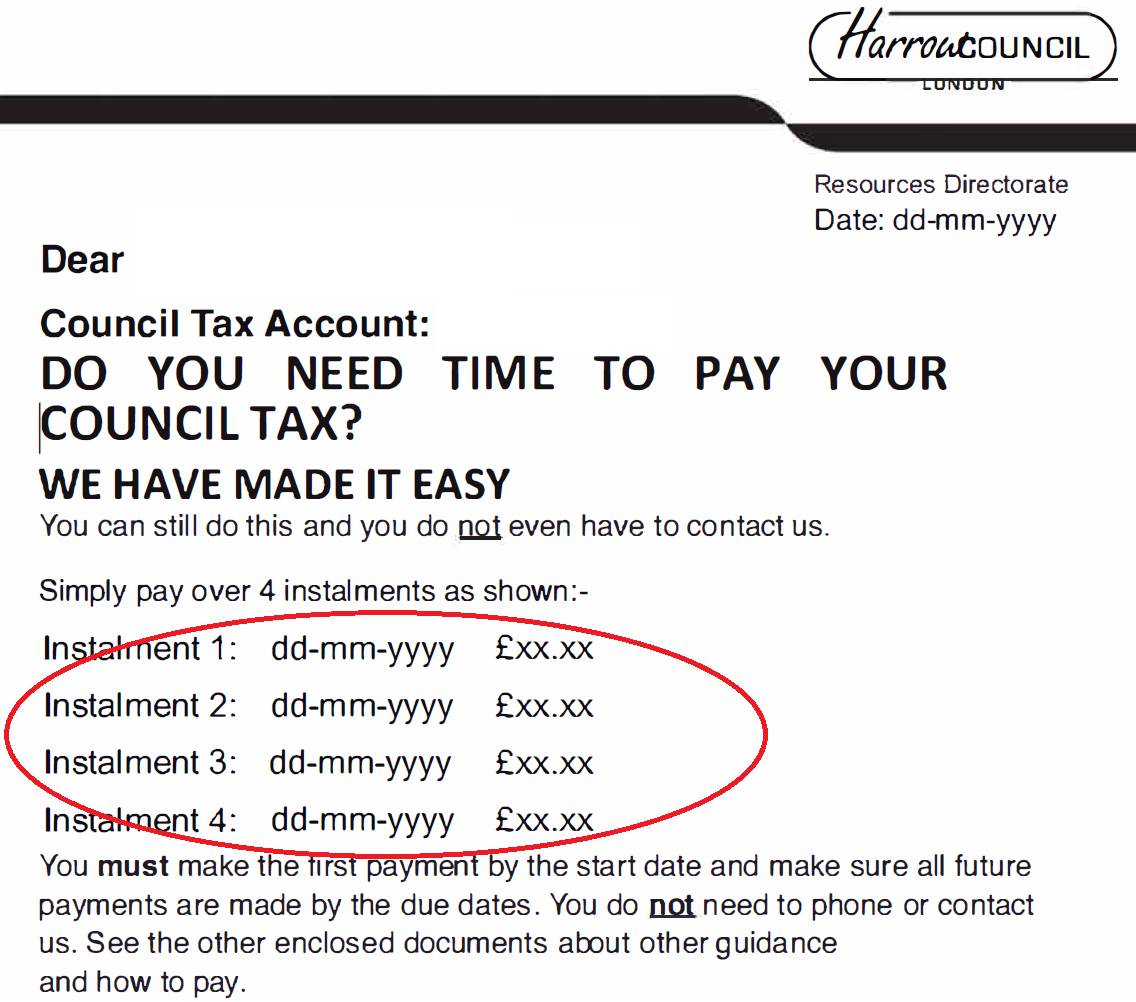

- Pay in instalments: Follow the instalment plan enclosed with your summons letter. This costs £5 more than paying in full. (How much are my instalments?)

You don't need to contact us. Make the payment using the link below.

To pay by phone call 020 8424 1220. You will need to have your Council Tax Reference number. For other payment methods, see Paying your council tax.

What to do if you cannot pay the summons

If you cannot pay as above, you can request a payment plan using the form below. The form will ask you to make an offer of payment for the Council's consideration.

You can choose from the following options:

- Pay missed instalment(s) plus summons costs and return to instalment plan (See an example)

- Request a payment plan for up to 6 months. You can only request this if you receive a qualifying benefit.

- Request that money is taken from my earnings.

- Request that money is taken from my benefits.

- None of the above

If you select 'None of the above' you will need to provide your financial information to make an offer of payment. If your offer is refused, the council will decide what further recovery action to take.

Before you start

- You will need to have your Council Tax Reference Number

- If you choose option 2 or 4 from the above, you will need to have your National Insurance number. You will need to upload your benefit award letter.

- If you choose option 3 you will need to have your Employer's details and your payroll number. You will need to upload up to 3 recent payslips

- If you choose option 5 you will need to provide financial information. This must include all your monthly income and outgoings. You should prepare this before starting the form.

- If you want to pay by Direct Debit you will need your bank account details.

What will happen if we cannot agree a payment plan?

The Council will ask the court for a liability order. This allows us to recover the debt using different methods including enforcement agents. You will receive a liability order asking you to pay the balance within 14 days. For more details see how we recover Council Tax debts.

What to do if you think the summons is wrong

If you think that the summons is wrong, you can send a dispute. You will need to provide:

- a letter explaining why you think it is incorrect

- any relevant supporting evidence.

You will need to pay while you are waiting for a decision.

Select the reason for your dispute:

I have made the payments, but the Council has not received them

Check MyHarrow to see if and when the Council received the payments. If a payment is missing, you will need to send proof of payment.

We can accept the following as proof:

- a bank or credit card statement showing that payment has been made

- a receipt

- any other valid proof that you have to show the missing payment

Please also attach a written explanation of your dispute. This can be a saved file, such as an MS Word document.

If you have moved out or should not be responsible for the Council Tax at this address

If you received a summons for an address which you have moved out of, make sure you have notified us using the move form.

You must pay the amount on the summons while you are waiting for the account to be closed.

If you believe you should not be responsible for council tax, you can submit a dispute using the evidence upload form.

You must pay the amount on the summons and continue to make payments while the dispute is being looked into.

I cannot afford to pay

If you have not paid because you cannot afford it, you should:

- check to see if you qualify for a discount or exemption.

- find out if you qualify for Council Tax Support using our benefits calculator If you do qualify you will need to apply for Council Tax Support.

In most circumstances the summons will still stand and you will be expected to pay. You should request a payment plan.

I did not receive the bill, reminder or final notice

If you did not receive the original bill then you can check it on your MyHarrow account.

Not receiving a bill or reminder notice is not in itself a valid defence against a summons being issued.

I am waiting for the outcome of an application

If you have not paid while waiting for the outcome of an application then the summons is correct. You must always pay your Council Tax while waiting for a decision on any type of application.

You can use your MyHarrow account to check the progress of your application.

How to send your dispute

Before you send your dispute:

- have your dispute letter and supporting evidence ready to upload

- have your Council Tax Reference number

- before you can access the form, you will be asked to sign in to your MyHarrow Account. If you do not have an account, please select 'Complete a form without logging in'.

Request to attend a court hearing

If you believe that you do not owe or should not have to pay the Council Tax, then you must contact us at least 7 days before the hearing. If agreement cannot be reached, please use the form provided on the summons. The Court may offer you a hearing by electronic means. You will need to contact the Council directly to discuss this.

There are limited defences against a Council Tax Liability Order. In order for the Court to grant a Liability Order, the Council has to prove that:

- there is an entry in the current Council Tax Valuation list

- the bill and reminder were posted to the correct address

- and that you have not paid the Council Tax amount concerned

The following defences are not valid:

- you have brought your instalment payments up to date

- you pay every month but not on the due date

- you have submitted an appeal against the Council Tax band for your home

- you have submitted an application for Council Tax Support

- you have submitted a complaint against the Council

To dispute the summons for any other reason, please contact the Council using the Evidence upload form.

Please read the information sent with the summons letter before you send a dispute or request a hearing.