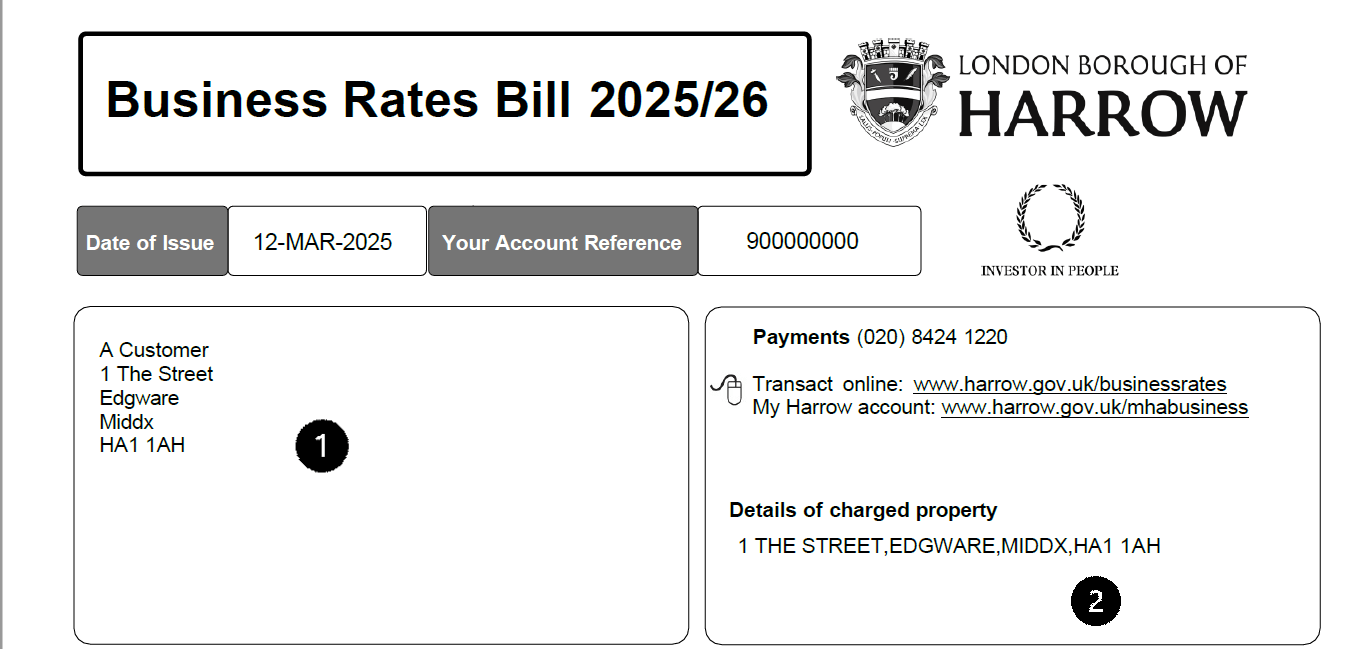

Business rates example bill

- This is the address you have given us for your bill to be sent to.

- This is the address that the bill is for.

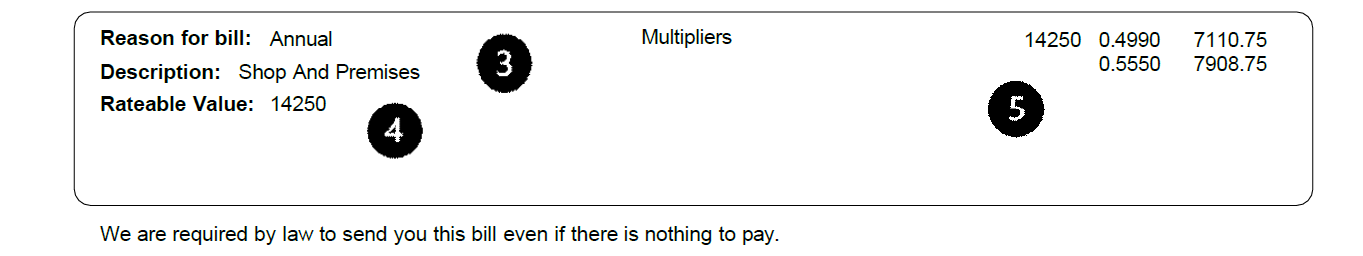

- This shows the reason why we have sent a bill and the description of the property

- This shows the rateable value given by the Valuation Office.

- This shows the multiplier used to work out your bill, and where applicable any transitional calculation

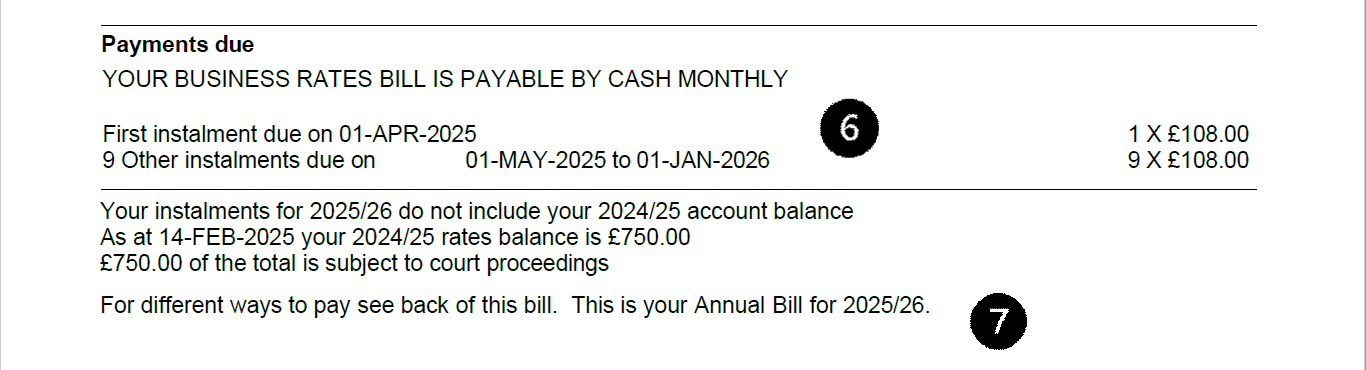

- This is how you have chosen to pay your bill, for example by Direct Debit and the dates your instalment payments are due

- This tells you if you have paid less or too much for the previous year. If you have not paid enough, in the previous year the outstanding amount will show here. If you have paid too much, that amount will be used to reduce your current year’s bill

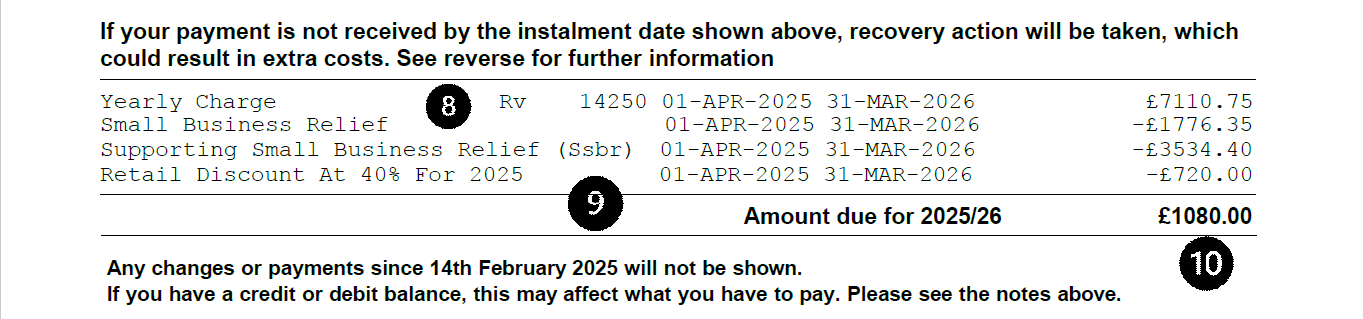

- This tells you the rateable value of your property, and the dates the charge relates to

- This tells you about any reliefs or exemptions that you receive and the transitional calculation you receive. It also tells you the dates and the amount by which we have reduced your yearly charge

- This tells you the total amount that you need to pay. This amount will be reflected in your instalments. If your balance is nil then you do not have to pay anything. If you have paid too much from a previous year and it is more than the amount payable for the current year you also do not have to pay. In both cases you will not have any instalments.